Digital Customer Onboarding: 9 Best Practices for Banks & Credit Unions

I write about fintech, data, and everything around it

Great digital customer onboarding is the very important for a stranger to become a client, promoter, and important part of your business. Check out these 9 best practices for banks and credit unions to improve their digital user/member onboarding experience.

Let’s admit it.

Our lives are increasingly digital and that’s a big opportunity for banks and credit unions to attract customers. In fact, nearly two-thirds of consumers would be willing to switch financial institutions for a better digital experience.

Fast and superior customer experience is the new bandwagon. And banks are not immune to this customer expectation. Why you ask?

Well, let’s face it. Signing up for a new bank account, a credit card, or a loan is usually quite a hassle, to say the least. Unfortunately, many banks are still using paper-based customer onboarding processes, which often end up taking more than 5 minutes. And those who have moved to digital customer onboarding don’t have the right UI/UX in place.

The result is that customers spend too much time on paperwork, filling out forms, and asking for documents. This leaves them feeling frustrated and looking for a faster way to sign up with another bank or service provider.

And they’re not wrong. Research from Mintel reveals that almost 60% of customers would rather sign up digitally than fill out a paper form in person, and about 40% have spent more than 5 minutes completing the process. The research also found that 55% of millennials say that using online or digital channels is easier for them to complete customer onboarding forms.

Monzo, Revolut, Starling, and many others already provide a seamless and quick service. In fact, banks and traditional financial institutions can also offer it with relative ease. But the problem is that many of you don’t have a clue about how to do so, and those who know don’t take immediate action, resulting in increased churn in the onboarding stage.

Luckily, there are solutions at hand!

But, before we get to that, let’s first understand what digital customer onboarding is.

Let’s dive right in.

What is Digital Customer Onboarding?

There are multiple definitions for digital customer onboarding, but basically, digital customer onboarding is the process of acquiring new customers online. The key word here is “process.” Digital customer onboarding isn’t just measured by signups, but also by conversions and post-signup engagement.

Digital customer onboarding is the process of converting new website visitors into customers by taking them through a seamless, personalized journey on the web. The goal is to reduce friction so that customers can be acquired online with as little effort as possible.

The goal of digital customer onboarding is to get new customers to buy or use your product or service, while at the same time maximizing their lifetime value. It’s a delicate balance that’s changed how many organizations think about customer acquisition and retention.

In this article, we’ll go over why you should care about digital customer onboarding and how to do it right.

9 Best Practices for Banks & Credit Unions for a Successful Digital Onboarding

For banks and credit unions, customer experience is more important than ever. The way you treat your customers impacts their satisfaction with your institution, their future behaviors, and even whether they’ll spread the word about your brand.

Here is a list of 9 best practices that companies can use to improve their digital customer onboarding:

1. Focus on customer goals

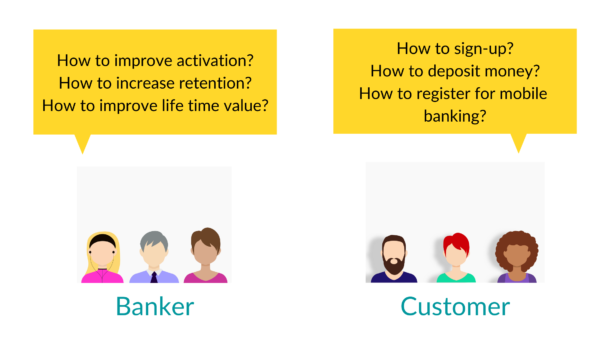

Banks need to rethink their onboarding process. Why? Well, what you perceive as your problem in customer onboarding can be very different from what your customers actually want. Therefore, you need to understand and provide step-by-step assistance to help them complete the onboarding process.

Understanding your customers becomes even more important when you are digitally onboarding your customers. That said, the best way is to start by talking to your customers directly and parallelly analyzing your initial digital customer onboarding data to determine the leanest way to onboard a customer.

Remember, always focus on your customer goals than yours. You need to solve their problems at every step by anticipating them. Make sure you onboard your customers smoothly. First impression lasts forever!

2. Frictionless customer onboarding

During digital customer onboarding, the customer experience plays a significant role. For that reason, it is very important to create experiences that are easy to understand and use.

Banks and credit unions need to identify what steps are unnecessary to complete the digital customer onboarding and should get rid of them. These initial barriers are the key reasons for losing your potential customers in the first place.

Check your digital customer onboarding data to understand what is/isn’t helping customers achieve what they want. Also, find out whether it is solving the customer’s problems.

The paradigm shift banks need to make here is to guide decisions to solve problems. So start today and provide a frictionless digital onboarding experience.

3. Customize onboarding

All your customers are not the same. You can’t have the same onboarding process for all of them.

Understand and bucket who your customers are and their aspirations, desires, and motivations to provide a personalized digital onboarding experience.

Understanding this will make it easy for your customers to quickly onboard and start off with their first transaction. But how do I know what my customers want?

Well, start by collecting data from the initial set of customers and keep optimizing your digital onboarding workflow till you get it right. Personalized digital onboarding helps elevate customer experience and also helps reduce churn rates.

Remember, superior customer experience is the differentiation you can bring in the overly crowded banking industry.

4. Avoid asking too many questions

By this stage, your customer has already made a choice to open an account with you. Please don’t make him regret his choice by bundling your digital customer onboarding with multiple steps. Collect minimum data as possible while onboarding a customer.

A 15-step customer onboarding is a huge effort for the customer and a potential revenue loss for the bank. Your digital onboarding process needs to be very precise for the customer. Also, explain what should be done and, most importantly, why it needs to be done at each step of data collection. Lastly, bring visual elements to guide the customer at every stage of the onboarding process.

Remember, customers like a reason to proceed. And answering them at every step will build trust and also fasten the onboarding process. The key to successful digital onboarding is to keep your onboarding steps minimal and very clear. Keep it simple.

5. Make sure you’re offering mobile-friendly processes

We ran a pilot study on popular banks a few months back. We found that more than 50% of banks and credit unions are actively providing banking products and services on mobile applications.

But what came as a surprise was, that most of them did not provide customer onboarding on their mobile application. And the ones who did allow to open an account from a mobile app did not authorize customers to create online banking credentials from the mobile. Instead, customers had to log in to the website.

If your bank already has a mobile app, add a customer onboarding facility right away. And don’t forget to keep it simple and memorable. Delighting your customers with unexpected features will turn them to brand advocates. Act today!

6. Make it fast (and seamless)

Don’t make customers fill out multiple applications in separate systems, or force them to set up a separate online banking and mobile banking login. There’s no reason to ask customers to reenter their information when they want to switch the form factor they use to complete an application, so don’t do it.

Some institutions require consumers to present an ID at a branch when they finish an application, just in case the bank wants to verify that the person applying is actually the one who filled out the form. A better option is to take a picture of their ID during the application process and store it digitally.

Allowing customers to upload documents during the application process, instead of having it done via mail or in person, also helps speed things along, while creating a better experience for everyone.

7. Make it easy and fun

A lot of companies make the mistake of assuming customers want to set up their accounts as quickly as possible. It’s almost always more important to make it easy and fun than it is to make it quick.

A lot of companies make the mistake of assuming customers want to set up their accounts as quickly as possible. It’s almost always more important to make it easy and fun than it is to make it quick.

Here are some ways to accomplish that:

- Allow users to link existing social media, email or bank accounts with their new account (even if they don’t have the same name). This will automatically fill in a lot of fields for them and eliminate the need for unnecessary typing.

- Offer optional profile pictures and emojis, which help users personalize their accounts and add personality.

- Provide helpful tips along the way — but not too many. Users should be able to skip these if they choose.

8. Leverage the power of retargeting and remarketing

When it comes to customer acquisition, banks and credit unions are sitting on a lot of missed opportunities. A big one is that only a small percentage of website visitors take the next step to become customers. One way to convert more visitors is to take advantage of retargeting and remarketing — two powerful tools for converting website browsers into customers.

If you’re not familiar with these terms, retargeting is when an ad follows a web user around the internet, while remarketing involves reminding potential customers about a specific offer or service.

The truth is, most financial institutions aren’t using retargeting or remarketing because they don’t understand the concept or they simply don’t think it’s effective enough to get the job done.

9. Don’t confuse customers

The more jargon and technical terms you use, the more likely your customers are to get confused and frustrated. In fact, 45% of consumers would leave a bank’s website because of confusing content. Instead, use simple, straightforward language to explain your products and help customers understand what they need to do during onboarding.

Use friendly, encouraging language to motivate customers to continue through the process – even when they’re confused or frustrated.

Final Thoughts

Research shows banks & credit unions could be losing as much as $6 million every year from poor CX during the customer onboarding process. This can have a dramatic impact on the growth of your institution, customer satisfaction and ultimately, your bottom line.

Remember, customer onboarding should be simple, fast, and frictionless. When customers see speed, ease, security, and convenience, they become loyal brand advocates. So, making your customer experience the best can be your strongest competitive advantage. In case you are wondering where to start? Well, we can help.

Zuci Systems partner with financial institutions and empower them to utilize their data more effectively by helping them collect, enhance, analyze, present and act on their financial data.

If you are interested in knowing more about our work, check out how we redesigned end-to-end UI/UX for a leading expert in the consumer finance industry.

Want to wow your bank’s customer experience? Our digital banking solutions can help your bank create delightful digital-led customer experiences that produce business results. Schedule a call with our UI/UX experts here.

Read Next:

Related Posts